refinance closing costs transfer taxes

Thank you for the response. Real estate transfer taxes are considered part of the closing costs in a home sale and are due at the closing.

Loan Estimate Explainer Consumer Financial Protection Bureau

You cant deduct more than 10000 per year 5000 if married filing separately in property taxes sales taxes and state and local income taxescombined.

. These costs include the escrow fee the title insurance the appraisal fee the. Transfer Tax 20 --15 County 5 State First 22000 used to calculate County tax is exempt if property is owner occupied Property Tax 1247 - per hundred assessed value. In a refinance transaction where property is not transferred between two parties no deed transfer taxes are due.

Refinance Property taxes are due in November. You closing costs are not tax deductible if they are fees. Review tax rates try our closing cost calculator for refinances.

This program gives a five 5 year real estate tax abatement and begins the October 1st after your closing date. County Transfer Tax see chart. Form 1098 a mortgage tax form you receive from your mortgage company provides only information about the mortgage interest and property taxes paid in the prior year.

Unfortunately this can also be costly as many different mortgage fees and closing. Nonrecurring closing costs include the one-time fees that buyers pay only at the time of purchase. When the same owners retain the property and simply complete.

Understanding Refinance Mortgage Tax Deductions in 2022. Transfer taxes are not tax-deductible against your income tax but can. If I borrow an additional 4k for closing costs with a remaining principal at time of refinance of 101 million.

You can only deduct closing costs for a mortgage refinance if the costs are considered mortgage interest or real estate taxes. By Bryan Dornan bryandornan. DC MD VA.

When you buy sell or refinance a home closing costs are a major part of every transaction. There is a doc stamp of 350 per thousand and an intangible tax of 250 per thousand required on every refinance in Florida. March 12 2020 1159 AM.

Calculate recordation tax on a refinance. You also qualify for an exemption of the above 11 Recordation tax and an. Most people who buy a home or refinance an existing mortgage pay closing costs.

Ma Properties Online An Explanation Of Closing Costs And And How To Calculate Them

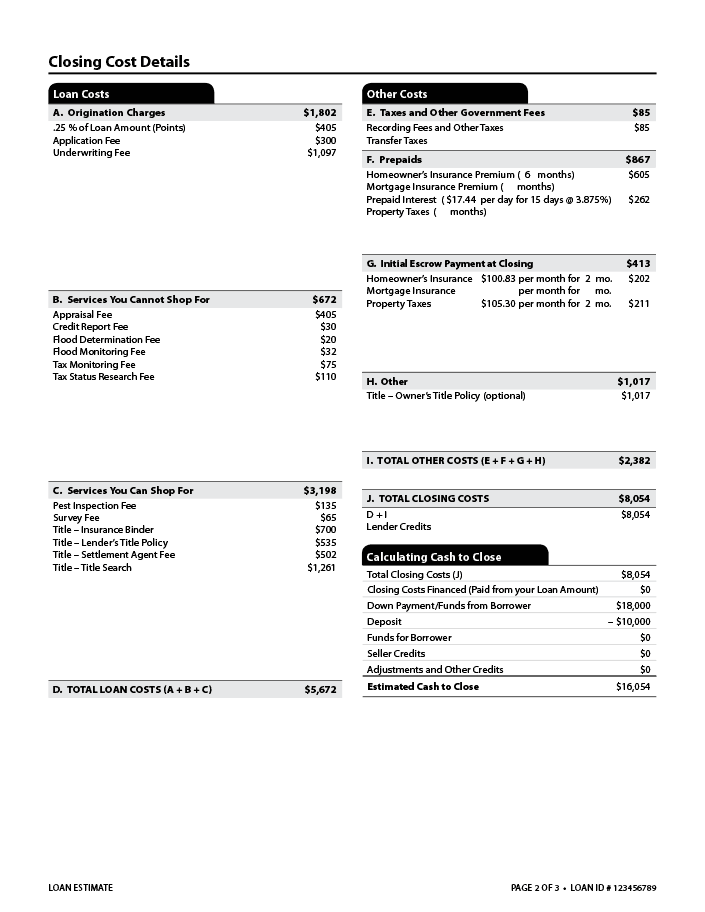

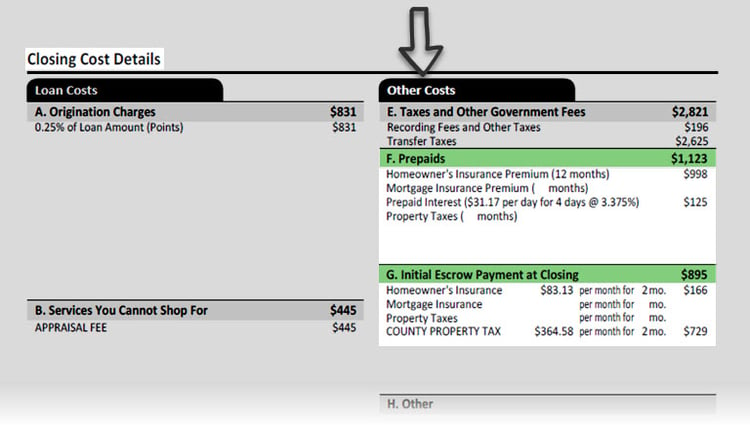

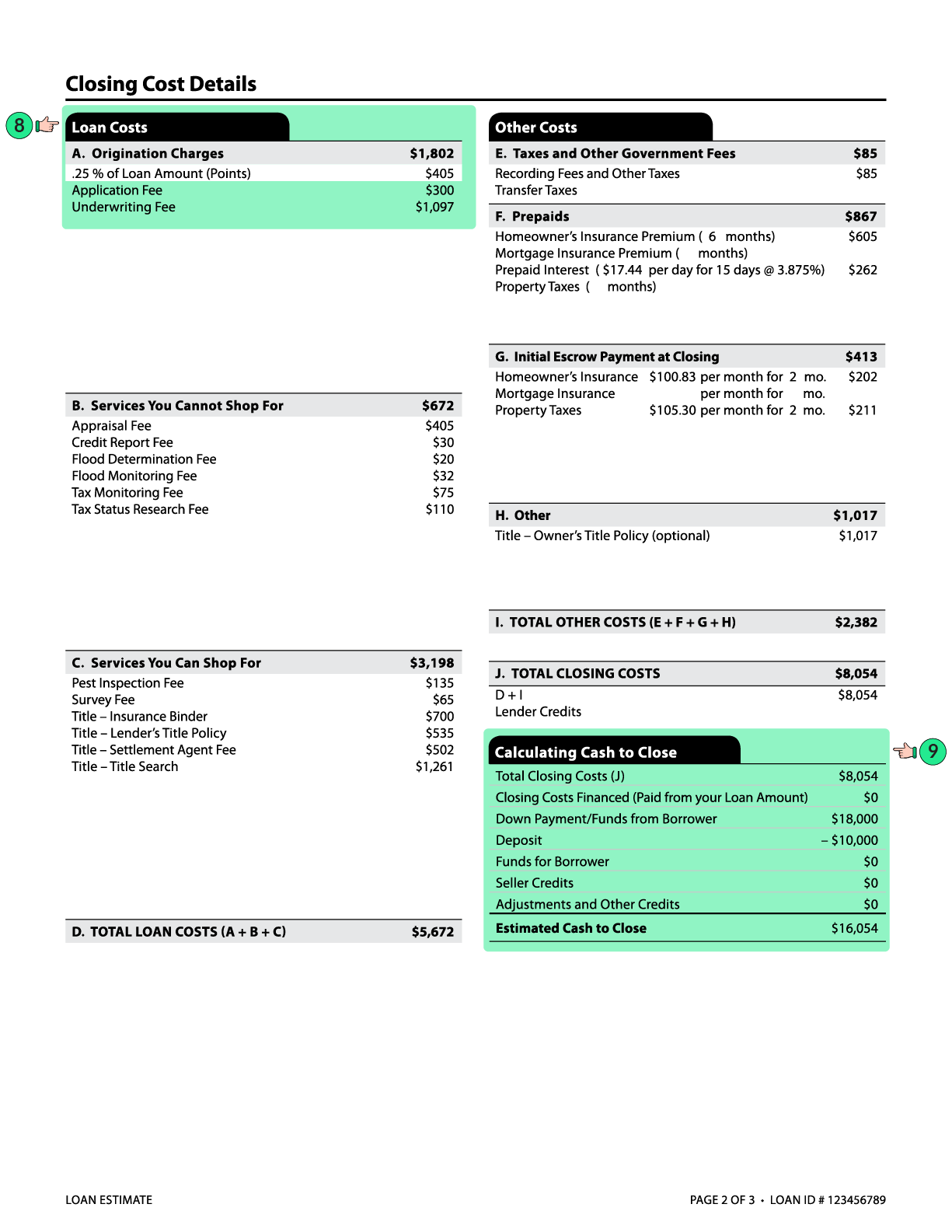

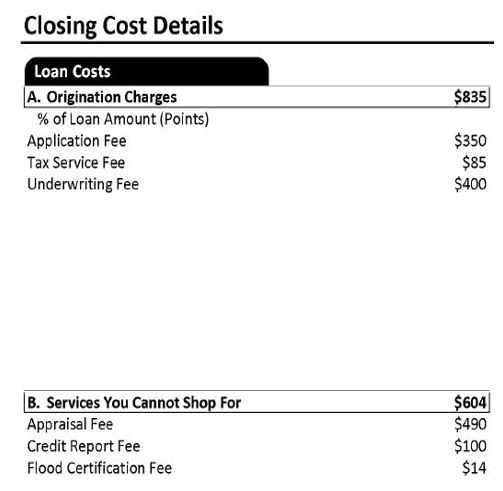

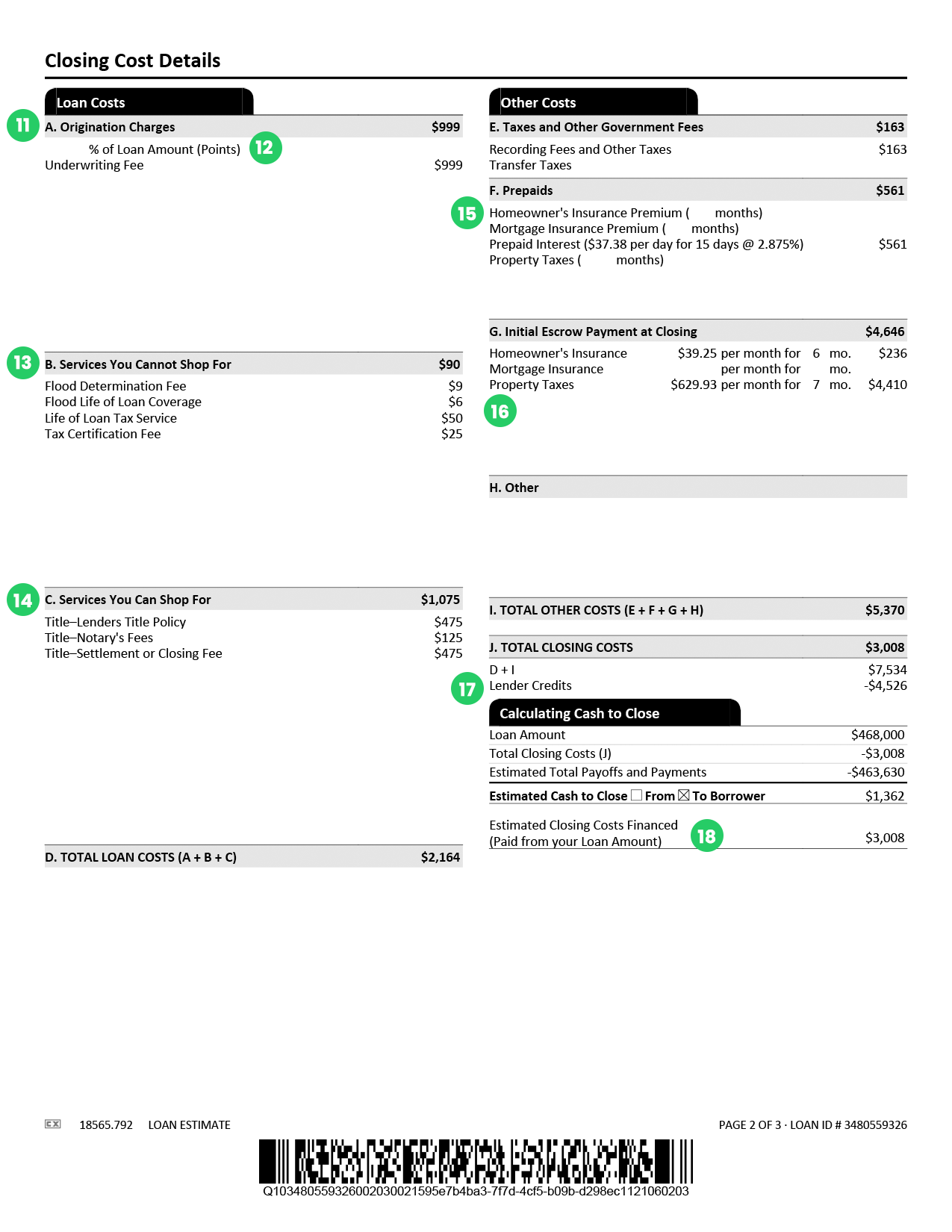

What Is A Loan Estimate How To Read And What To Look For

Why Are My Closing Costs Higher Than I Anticipated

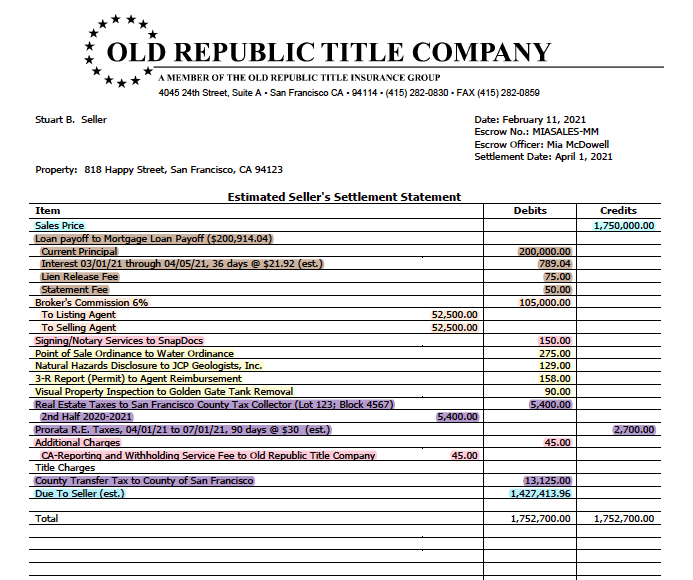

The Estimated Settlement Statement Jackson Fuller Real Estate

Understanding Closing Costs Sirva Mortgage

Escrows Prepaids At Closing What You Should Know U S Mortgage Calculator

Transfer Tax San Francisco What Do Home Sellers Pay Danielle Lazier Real Estate

Reducing Refinancing Expenses The New York Times

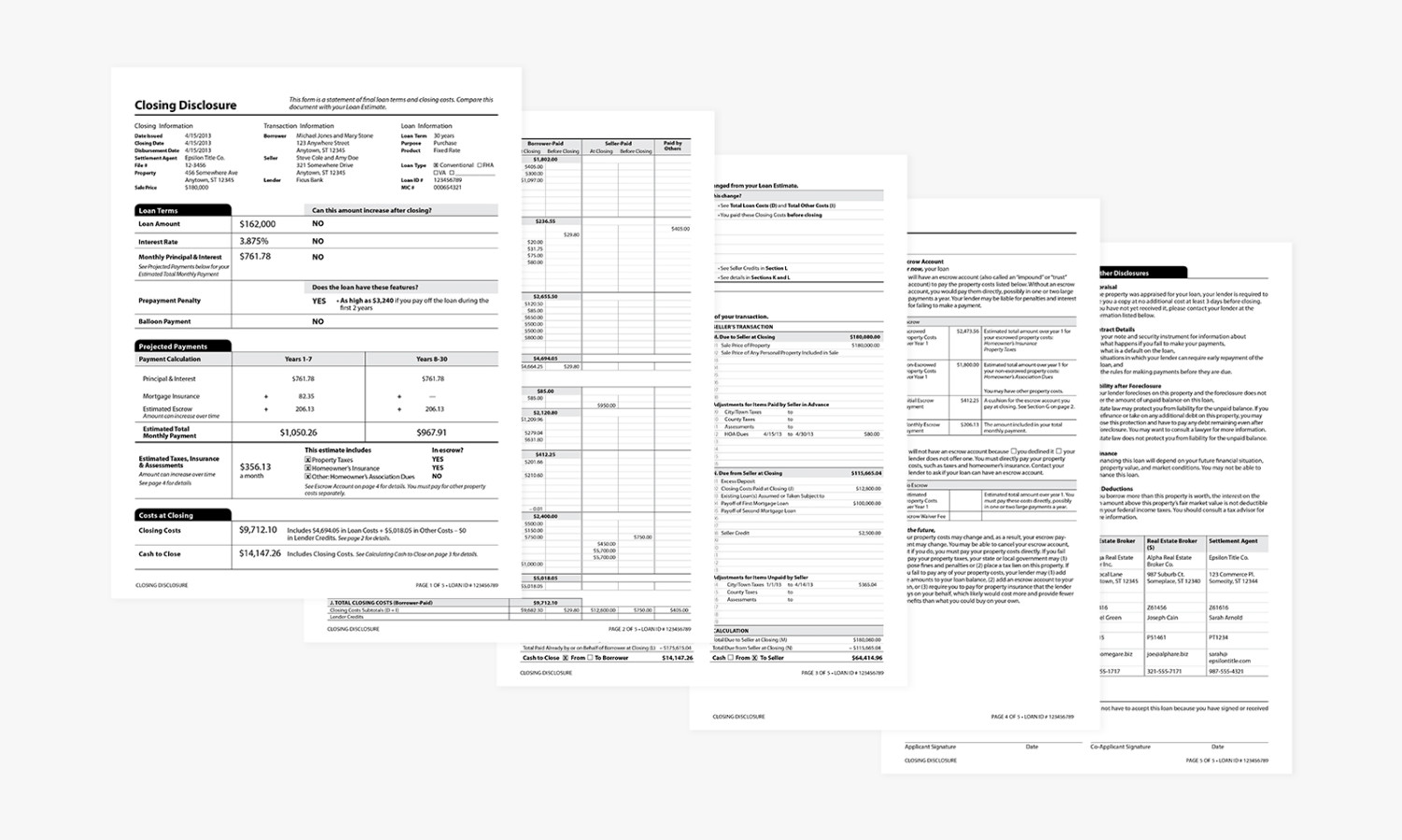

A Guide To Understanding Your Closing Disclosure Better Better Mortgage

Closing Costs What Are They And How Much Rocket Mortgage

The Escrow Process Westlake Village Escrow

Saving New York State Mortgage Recording Tax Gonchar Real Estate

Mortgage Loan Estimate Guide Selfi

How To Estimate Closing Costs Assurance Financial

What Are Closing Costs And How Much Will I Pay

Average Closing Costs In 2022 Complete List Of Closing Costs

/shutterstock_299702729_closing_costs-5bfc3181c9e77c0026317a8f.jpg)

Understanding Mortgage Closing Costs

Ultimate Guide To Your Mortgage Closing Disclosure Forbes Advisor